Incentives

Aggressive Incentives Built for New Quality Job Creation and Investment

St. Joseph is aggressive in the case of incentives to bring quality projects to our city. The St. Joseph Economic Development Partnership will work diligently to structure an incentive package that is attractive and forward thinking.

We are dedicated to working with all involved to create a mutually-beneficial project that will assist your company in successfully achieving its goals and becoming an integral part of the St. Joseph community.

Our successes with Triumph Foods, Daily’s Premium Meats, Schutz Containers, Cereal Ingredients, Boehringer Ingelheim and more in the location and expansion of their most modern and technologically-advanced facilities are prime examples of this ability.

Local Incentives

Funded by the one-quarter cent sales tax originally passed in 1996, the funding provides flexible dollars for economic development projects. Usually the funds are provided in the venue of five-year forgivable loans, contingent upon certain milestones of job creation and investment being met. Funds are secured by an irrevocable letter of credit while the loan is outstanding.

Mechanism in the state of Missouri for real and personal property tax abatement for eligible projects. The City of St. Joseph issues Industrial Revenue Bonds that are and purchased by the company that technically purchase the project improvements and/or equipment. Under the arrangement, the governmental entity retains ownership of the real and/or personal property and leases it back to the company. Because title to the real and/or personal property is held in the name of the City during the lease term, the City has the ability to abate a portion of the taxes. The company assumes ownership at the end of the term of the bonds and the tax abatement ends. Due to bond issuance costs, program is typically beneficial only to larger projects in excess of $5 million.

Provides a 50 percent local real estate tax abatement on new property improvements. The number of years of tax abatement is a maximum of 10 years, or through the end of the program, currently slated to end on July 5, 2030, whichever comes first. New eligible projects must have at least $100,000 in capital investment and the creation of two new jobs meeting eligibility requirements.

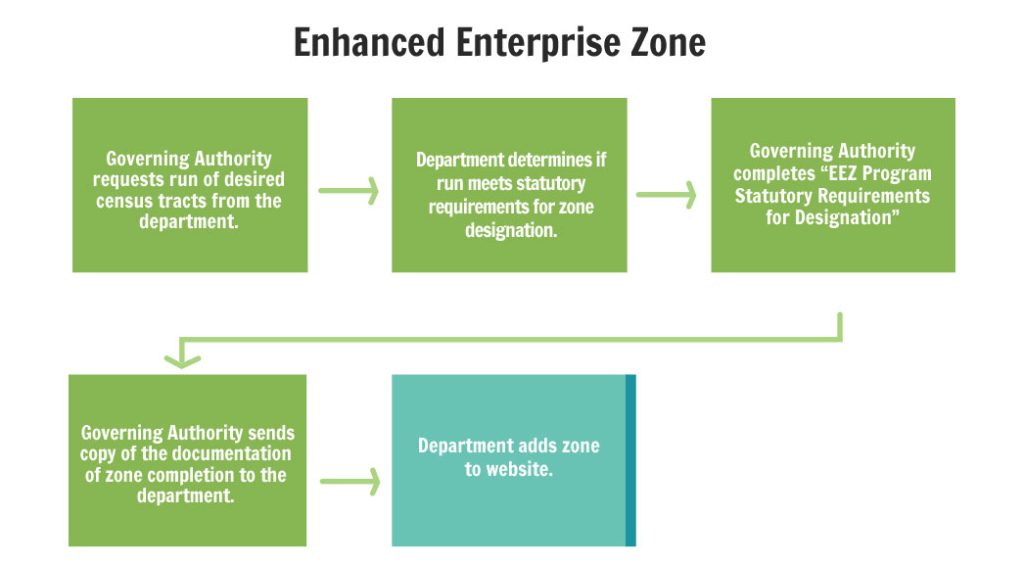

Projects must be located within the designated St. Joseph EEZ area. Eligible businesses are manufacturing, mining, warehouse/distribution, and wholesale trade.

State of Missouri Incentives

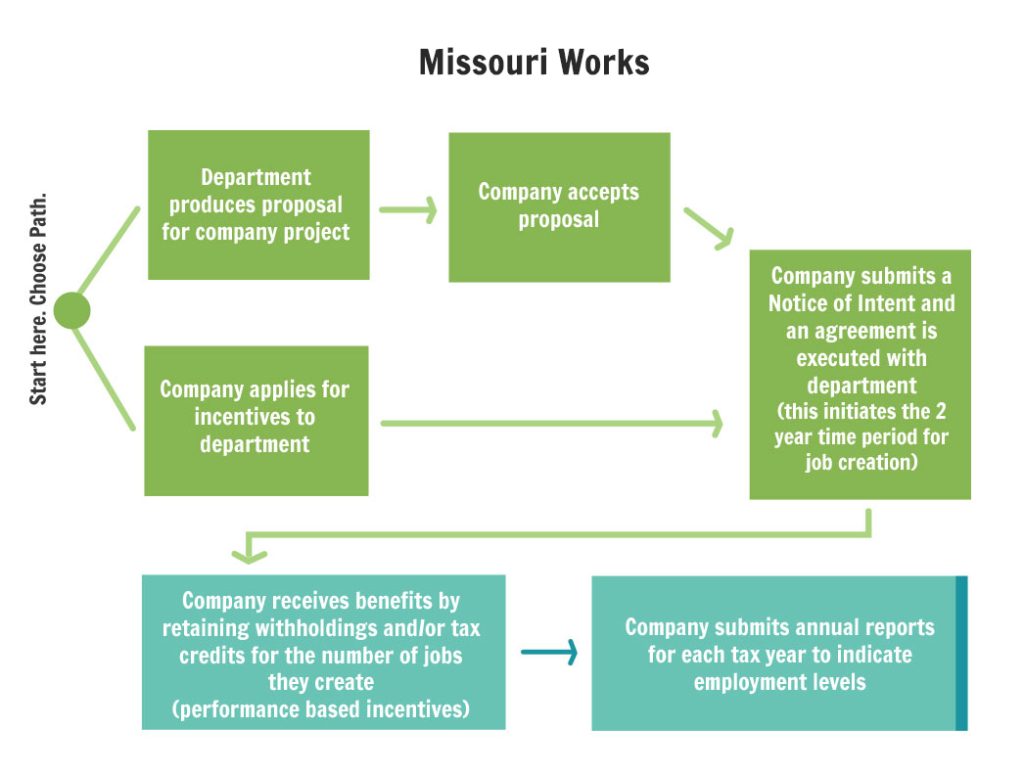

Missouri Works Program – Program benefits are (a) the retention of the state withholding tax of the new jobs and/or (b) state tax credits, which are refundable, transferable and/or saleable. The program benefits are based on a percentage of the payroll of the new jobs. For specific requirements, please see: Missouri Works Program – Program benefits are (a) the retention of the state withholding tax of the new jobs and/or (b) state tax credits, which are refundable, transferable and/or saleable. The program benefits are based on a percentage of the payroll of the new jobs. For specific requirements, please see an overview here.

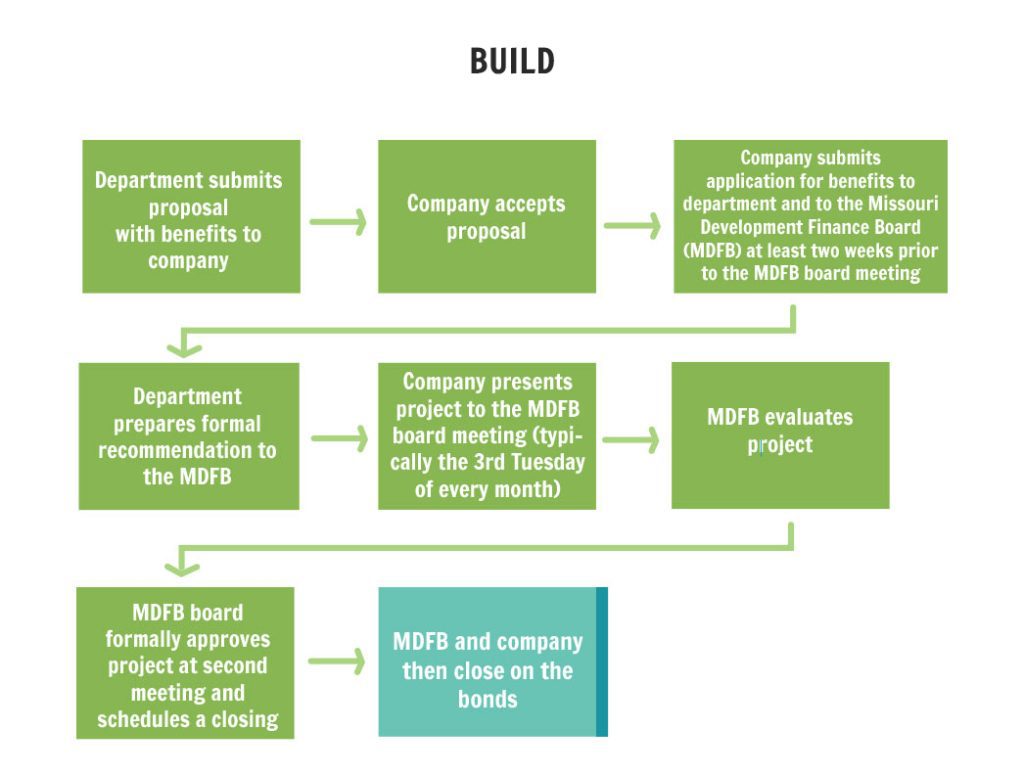

The BUILD Missouri Program is an incentive tool that allows the Missouri Department of Economic Development and the Missouri Development Finance Board to provide a financial incentive for the location or expansion of large business projects (minimum 100 new jobs/$15 million capital investment for industry related projects, and minimum 500 new jobs/$10 million capital investment for office related projects.) The program is designed to reduce necessary infrastructure and equipment expenses if a project can demonstrate a need for funding. For specific requirements, please see an overview here.

Utility Economic Development Riders

Evergy (electric), Missouri American Water Company, and Spire (natural gas) all have utility economic development riders for large industrial projects. The projects must meet certain criteria of new high utility usage requirements and job creation. The programs typically provide a certain percentage reduction by year after start-up, over a five year period. Riders must be approved by the utility company prior to a public announcement of the project.

Other Programs for Special Circumstances

With a Community, Neighborhood, or Downtown Improvement District, an established district is voted in by the property owners and the municipality issues bonds to pay for eligible infrastructure improvements. The bonds are then paid for by special assessments against the real property.